This is probably a post that can be categorized as a first-world problem, but it’s something that I found difficult to figure out by myself, and I thought it may be interesting to other free software users who happen to work for a company that provides stock grants as a form of compensation. As it happens, I’m one of them.

Many years ago I set up my accounting through GnuCash, because I needed something to keep track of the expenses of my company, back when I had one. Being stubborn and pedantic, now four years after closing said company, I still keep running it and I have a nearly complete accounting of my expenses, for sure from 2009 (time from which I started recording all movements on the credit cards) and some before — I actually manually imported all operations on my bank account from its opening in 2005!

One thing that was not very clear to me how to handle, as setting up proper accounts to track the compensation in form of stock. The as usual unnamed company I work for provides me with a part of compensation in form of stock grants, as long as I work for them. The tax implications of these grants are a bit complicated, but boil down to needing to know the “fair market value” (FMV) of the stock at vesting, and the exchange rate for that month on the Irish Revenue website, since the stock is valued in dollars, but my taxes are in Euro (and do note that it does not matter when you transfer that money, as far as I can tell, which is both a blessing and a curse of course).

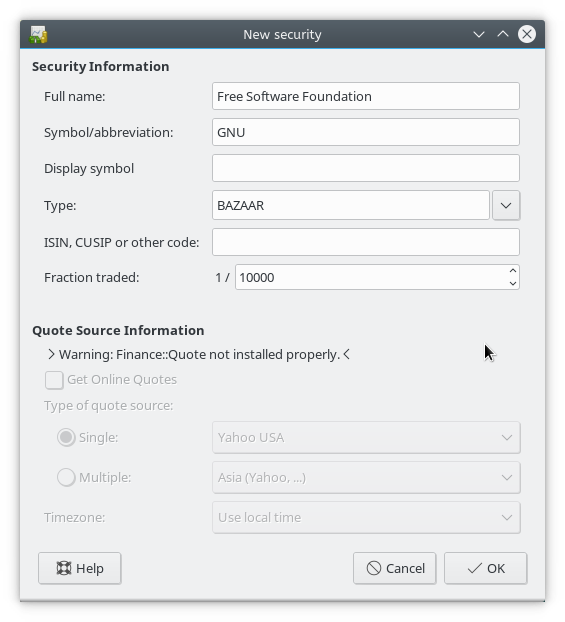

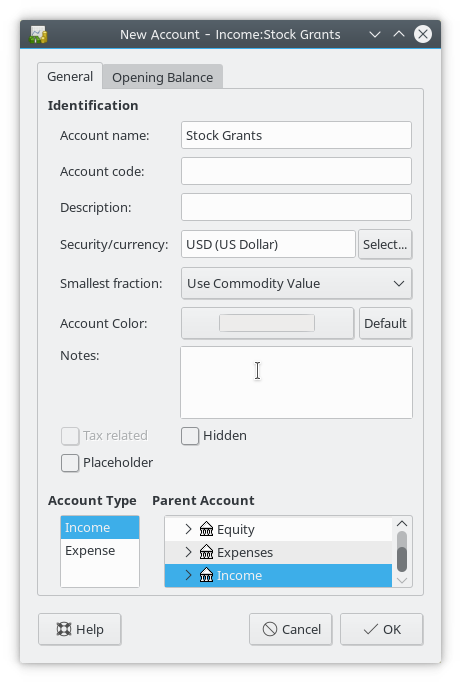

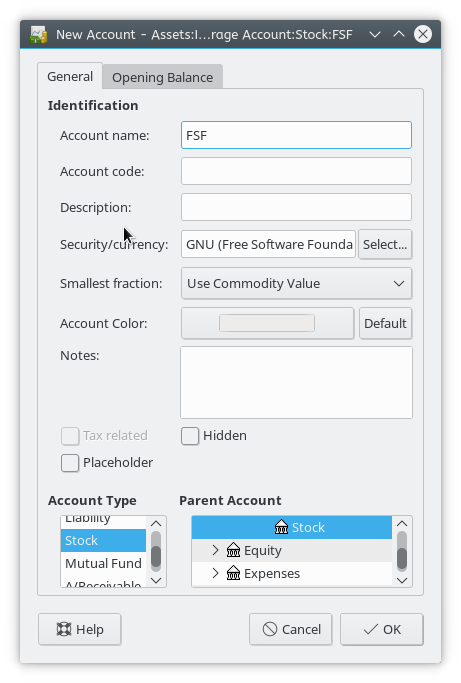

For this description to work, your GnuCash file needs to be set to Use Trading Accounts, as that makes it much nicer to have multiple currencies and securities in the same transaction. You also need to create a new security (symbol), a new income account and a new stock account. For the first you select Tools → Security Editor → Add, the two others can be created by right clicking on the Income and Stock accounts respectively, and choosing New Account…:

Once you open the newly-created stock account, it will show you a number of column as usual for GnuCash, but in particular it’ll have the stock-specific Price, Buy, and Sell column, which are used for trading. What was definitely not originally clear to me before was that the price is always expressed in the default currency of the GnuCash file, which as far as I know is not editable.

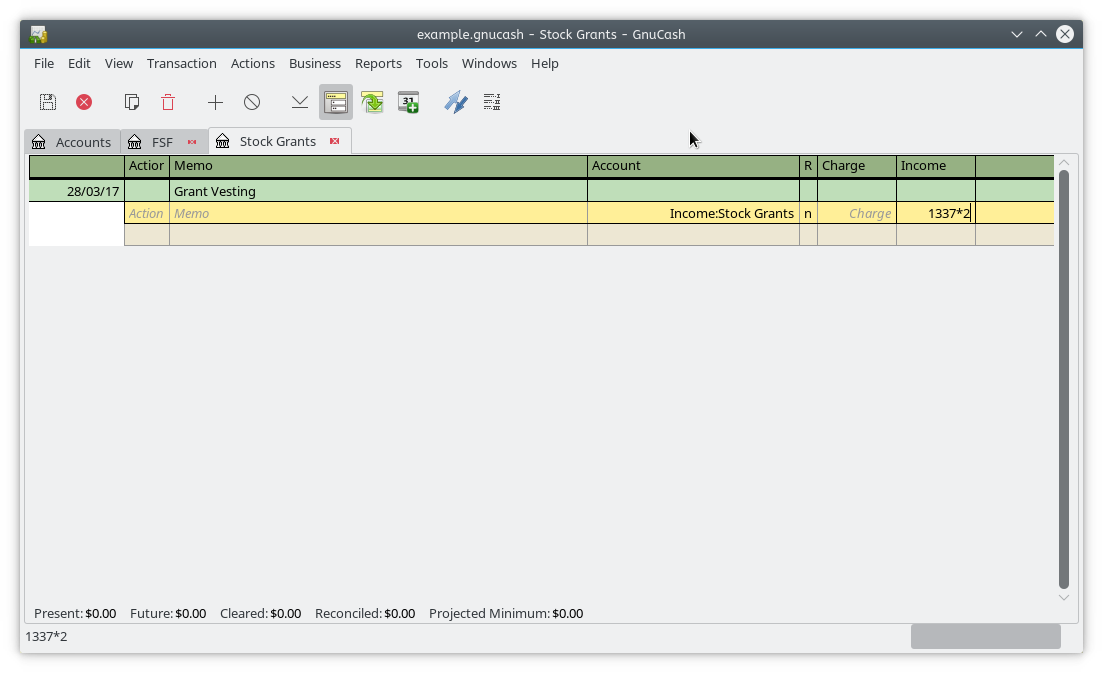

You can of course manually calculate the value at time of vesting by using the FMV and the exchange rate, but it becomes quite more complicated in my opinion. So instead, whenever one of my grants vests, I’m now going to the income account to record it. This account is denominated in dollars, which match the symbol’s currency, and we’ll use it to add new stock to the stock (or asset) account.

Say for example as of today I received a grant of two stock units at FMV of $1337 (note I expanded the splits of the line, that is on purpose because it makes it easier to edit):

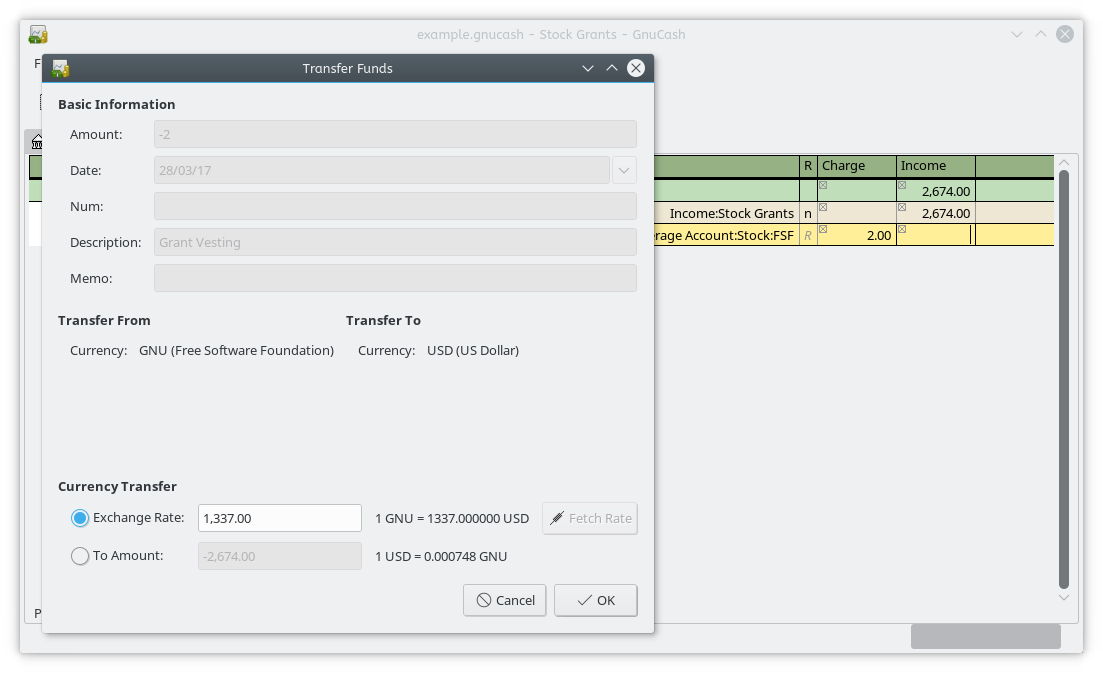

You then add a second split that points to the stock account created previously and insert the number of stock units (2) in that Charge. Again this only works correctly if you’re using trading accounts! Once you do that, the Transfer Funds dialog will pop up and it will have already the right “Exchange Rate” (which is actually the FMV at vesting time).

Up to now this is all good, now you have some stock, and the Buy field is actually showing the right price in dollars, but the account’s value is not going to be aggregated correctly in the Accounts page. This is because up until now we have made no effort of dealing with the exchange rate between USD and EUR.

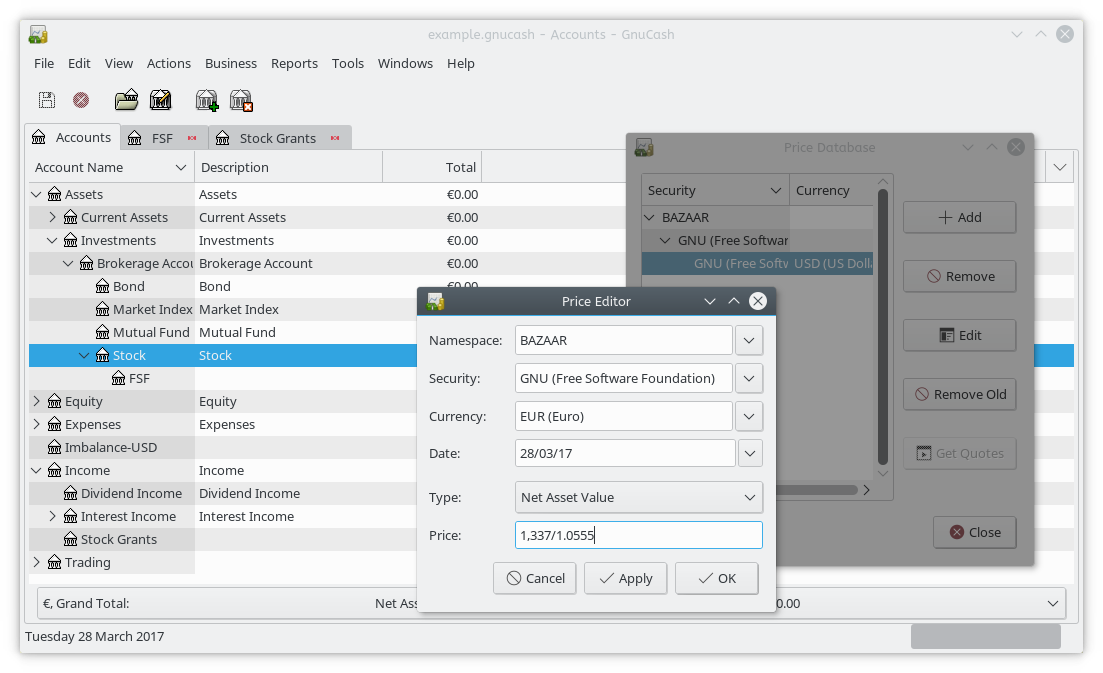

The easiest way to fix this is going to Tools → Price Editor, select the symbol and add a new price (I use Net Asset Value for type), and in the price divide the value in dollar for the right exchange rate.

Et voilà! Now you should have most of the data you need not only to keep an eye on the stock grants, but also to do tax reporting as you have recorded the FMV already converted to Euro, which is what you need there. Unfortunately, as far as I can tell, there is no easy way to export the prices in a nice table that you can just use for reporting. And I’m horrible with Scheme so I have not considered writing my own reporting module yet.

There is also another caveat: I have tried to track the grants already in two different ways in the past, and they did not work out very well. I’m seriously considering making a copy of my GnuCash file, delete the accounts altogether and recreate them following this simplified procedure. But that will probably be a bridge for another time.